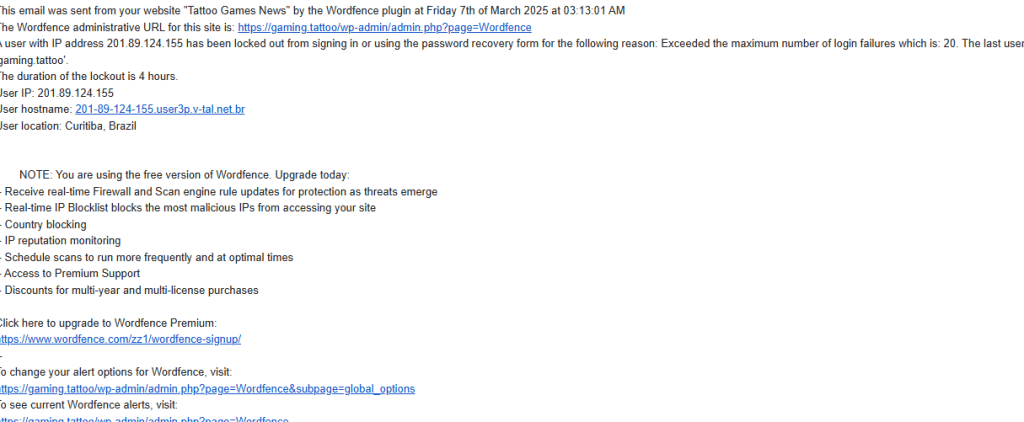

Reddit For Hire Scammer Attempting to log in

While social media platforms facilitate countless legitimate interactions, they also contain dark corners that may enable financial crime. Reddit, with its pseudonymous user accounts and vast network of specialized communities, presents unique vulnerabilities that may be exploited for money laundering activities and know-your-customer (KYC) scams. This report examines the potential ways Reddit might be used to facilitate financial crimes, the warning signs users should be aware of, and how these activities connect to broader patterns of online fraud.

Understanding Money Laundering in the Digital Age

Money laundering fundamentally involves transforming illegally obtained funds into seemingly legitimate assets through a process that obscures their origin. As explained by Reddit users, money laundering is “any scheme to make illicit money look like honest income” whether from stolen funds, criminal enterprises like drug trafficking, or other illegal activities1. The traditional approach involves establishing legitimate-appearing business fronts—often cash-intensive operations like restaurants, car washes, or strip clubs—where illicit funds can be mixed with genuine revenue and subsequently reported as legitimate business income1. For example, a restaurant generating $2,000 in daily legitimate business might report $10,000 in daily income, effectively “cleaning” an additional $8,000 of dirty money by making it appear as though it came from regular customers1.

In the digital age, however, money laundering has evolved beyond physical storefronts. Online platforms, cryptocurrencies, and digital payment systems have created new vectors for laundering illicit funds. According to Chainalysis data cited in discussions about cryptocurrency, nearly $24 billion in illicit funds moved through crypto channels in 2022 alone4. These funds often flow through privacy coins, crypto mixers like TornadoCash, or complex webs of digital wallets before being withdrawn through less reputable exchanges4. As digital platforms grow in popularity and accessibility, they increasingly attract those seeking to obscure the origins of illegal funds.

The pseudonymous nature of platforms like Reddit creates environments where financial criminals can potentially connect with unwitting accomplices, share techniques, or recruit money mules without revealing their identities. Unlike traditional banking institutions that maintain extensive customer data, decentralized systems and social platforms operate with significantly less oversight, creating exploitable gaps in the financial security ecosystem.

KYC Vulnerabilities and Identity Fraud on Social Media

Know Your Customer (KYC) protocols represent financial institutions’ first line of defense against money laundering and terrorism financing. These procedures require banks and financial services to verify customer identities through documentation, biometric data, and other identifying information. However, KYC systems contain vulnerabilities that sophisticated criminals can exploit, as demonstrated by the alarming case documented in search result2.

In this case, an individual named Ravi Singh discovered that his identity had been compromised when he received notification of changes to his Central KYC (CKYC) records2. The fraudster had maintained Singh’s name and birth date but substituted their own photograph, address, and phone number—effectively creating a hybrid identity perfect for financial fraud2. Using this stolen identity, the perpetrator secured loans from multiple financial institutions, including a 10,000 INR loan from KreditBee that appeared on Singh’s credit report2. Despite Singh’s extensive documentation proving the fraud, including cybercrime reports and KYC documentation, he faced significant resistance from financial institutions before finally achieving resolution through the RBI Ombudsman process2.

This detailed case exemplifies how identity thieves operate in the digital landscape and reveals potential connections to social media platforms like Reddit. Forums dedicated to KYC procedures, banking, or financial services could serve as reconnaissance grounds for identity thieves seeking to understand verification processes or identify potential victims. Additionally, Reddit’s pseudonymous nature allows users to share techniques and tools for circumventing KYC barriers with minimal personal risk. The r/CreditCardsIndia subreddit where Singh shared his experience demonstrates how these platforms become repositories of both legitimate information exchange and potential criminal reconnaissance2.

Social engineering represents a particular concern in this context. Through seemingly innocuous conversations and trust-building on social platforms, fraudsters can extract personal information piece by piece from unsuspecting users. Over time, these information fragments can be assembled into comprehensive identity profiles suitable for financial fraud. Reddit’s conversation-focused structure, where users often share personal experiences and details, creates particularly fertile ground for such operations.

The Cash App Connection and Cryptocurrency Vulnerabilities

Cash App, owned by Block and run by former Twitter CEO Jack Dorsey, appears frequently in cryptocurrency discussions on Reddit, particularly regarding Bitcoin purchases3. While most users report legitimate experiences—describing the app as “pretty legit” and “great for small purchases” with “free withdrawals”—the platform’s ease of use and accessibility also create potential avenues for exploitation3. Users frequently mention Cash App’s convenience for making regular small purchases of Bitcoin, its integration with Apple Pay, and the ability to “round up” debit card purchases to acquire additional cryptocurrency3.

This convenience, however, presents a double-edged sword. The same features that make Cash App accessible for legitimate cryptocurrency enthusiasts—minimal verification for smaller transactions, seamless transfers, and quick conversion between currencies—also create opportunities for money launderers. By using multiple accounts or recruiting third parties to create accounts (potentially through social media platforms like Reddit), criminals could structure large transactions into smaller ones that attract less scrutiny. The complexity of tracing funds increases exponentially when money moves from traditional banking, through Cash App, into cryptocurrency, potentially through mixing services, and back into different financial systems.

Cryptocurrency’s role in money laundering has grown significantly, with privacy coins and mixing services providing tools to obscure transaction origins4. While Bitcoin itself maintains a public ledger, additional technologies and techniques can complicate the tracking of funds. According to discussions on r/CryptoCurrency, criminals increasingly employ sophisticated methods including “privacy coins, crypto mixers like TornadoCash, transferring small amounts across a complex web of wallets, and off-ramping via less-than-reputable exchanges”4. These techniques fundamentally aim to disguise the origin of funds by creating enough complexity that tracking becomes impractical.

Reddit contains numerous cryptocurrency communities where discussions about these technologies occur daily. While most participants engage legitimately, these forums could theoretically provide criminals with information about emerging techniques, potential exploits, or access to individuals willing to participate in money laundering schemes. Direct solicitation for money laundering would likely violate platform rules, but coded language and private messages could circumvent such restrictions.

The Regulatory Landscape and Social Media Challenges

The regulation of financial activities on social media platforms presents significant challenges for authorities. Traditional anti-money laundering frameworks like the U.S. Bank Secrecy Act require financial institutions to record large transactions, report suspicious activities, and maintain comprehensive customer records4. However, these regulations were designed primarily for traditional banking systems rather than decentralized digital platforms.

Current regulatory discussions reflect this tension. Some policymakers, like Elizabeth Warren, advocate for broadly applying traditional banking regulations to the cryptocurrency ecosystem through legislation like the “Digital Asset Anti-Money Laundering Act”4. Critics characterize such approaches as “doing surgery with a baseball bat,” potentially hampering innovation while failing to effectively target criminal activity4. Alternative proposals, such as Tom Emmer’s “Blockchain Regulatory Certainty Act,” suggest more targeted approaches focusing regulations only on entities that take custody of customer funds4.

The fundamental challenge in regulating financial activities on social media stems from the decentralized, pseudonymous nature of both these platforms and many cryptocurrency systems. As one financial crime professional noted, traditional banks maintain extensive customer data—tracking login locations, devices, and interconnected accounts—that enables effective suspicious activity monitoring4. Such comprehensive monitoring becomes impossible in decentralized systems without compromising their core privacy features.

Some professionals in the anti-money laundering field express frustration with what they perceive as disproportionate focus on cryptocurrency compared to traditional money laundering vectors. As one commenter observed, “Banks are laundering billions for a single cartel, but the focus is on crypto. Doesn’t make sense to me”4. Others note that traditional channels like art markets, real estate, and cash-intensive businesses remain primary money laundering vehicles despite receiving less public attention4.

Identifying Potential Financial Crime Solicitation on Reddit

Reddit’s structure—featuring thousands of specialized communities or “subreddits”—creates both risks and opportunities regarding financial crime. Legitimate finance-related subreddits provide valuable education about personal finance, investing, and cryptocurrency. However, these same communities might attract those seeking to exploit financial novices or recruit participants for fraudulent schemes.

Several warning signs might indicate potentially suspicious activity on Reddit:

Solicitations to open financial accounts for others represent a significant red flag. Money launderers frequently recruit “money mules”—individuals who allow their accounts to be used to move funds—often by offering a percentage of the transferred amounts as payment. These solicitations might appear as job offers, investment opportunities, or requests for “help” with financial matters. On Reddit, such approaches might begin in public forums before moving to private messages where details can be discussed away from moderator oversight.

Requests to participate in “guaranteed return” schemes or unusually profitable ventures with minimal effort should trigger immediate suspicion. Legitimate financial opportunities rarely guarantee returns or require third-party participants for basic transactions. When combined with requests to open accounts or move funds through personal financial apps, these solicitations often indicate money laundering or other financial crimes.

The KYC fraud case highlighted earlier demonstrates another potential warning sign: discussions about circumventing identity verification procedures2. While legitimate privacy concerns exist regarding digital identity systems, detailed inquiries about bypassing specific KYC measures or creating synthetic identities often indicate fraudulent intent. Forums discussing financial services might contain such inquiries disguised as theoretical questions or complaints about verification requirements.

Conclusion

While the search results don’t provide direct evidence of widespread organized money laundering operations specifically on Reddit, they demonstrate several connecting threads between social media platforms, cryptocurrency services, and potential financial crimes. The combination of pseudonymous interactions, specialized financial communities, and private messaging capabilities creates an environment where financial criminals could potentially recruit participants, share techniques, or coordinate activities.

The KYC fraud case detailed in the Indian credit card subreddit illustrates how identity theft impacts real individuals and highlights the importance of monitoring personal financial information2. Meanwhile, discussions about cryptocurrency and Cash App reveal both legitimate uses and potential vulnerabilities that could be exploited for money laundering purposes34.

For Reddit users, awareness remains the primary defense against being drawn into financial crimes. Legitimate financial institutions never request users to open accounts on behalf of others, transfer unexplained funds, or participate in transactions with unverified parties. By maintaining healthy skepticism toward unsolicited financial opportunities, especially those promising easy profits or requiring minimal verification, users can protect themselves from becoming unwitting accomplices to money laundering or fraud.

As digital financial systems and social media platforms continue evolving, so too will the methods employed by those seeking to exploit these systems for illicit purposes. Understanding these risks represents the first step toward creating more secure digital communities while preserving the benefits of open communication and financial innovation.

Citations:

- https://www.reddit.com/r/explainlikeimfive/comments/13u4icw/eli5_what_is_money_laundering/

- https://www.reddit.com/r/CreditCardsIndia/comments/1i2i6tf/abandoned_by_the_banks_exposing_indias_kyc/

- https://www.reddit.com/r/BitcoinBeginners/comments/1czn7zr/cash_app/

- https://www.reddit.com/r/CryptoCurrency/comments/16ee6q5/how_bad_is_cryptos_money_laundering_problem_and/

- https://www.reddit.com/r/moneylaundering/comments/158bivn/how_kyc_and_aml_are_destroying_the_world/

- https://www.reddit.com/r/CashApp/comments/1grgqso/why_do_people_try_to_buy_my_cashapp_account_and/

- https://www.reddit.com/r/NoStupidQuestions/comments/1i5tigv/what_exactly_is_money_laundering/

- https://www.reddit.com/r/PiNetwork/comments/1daxcpm/kyc_checks_seem_to_be_no_longer_valid_are_we/

- https://www.reddit.com/r/Bitcoin/comments/18zx1m5/cash_app_is_better_than_exchanges/

- https://www.reddit.com/r/CryptoCurrency/comments/vluii8/how_hackers_launder_and_cash_out_their_stolen/

- https://www.reddit.com/r/mauritius/comments/1dtu2e6/what_is_kycknow_your_customer_all_about/

- https://www.reddit.com/r/CashApp/comments/1imbq22/cash_app_banned/

- https://www.reddit.com/r/CashApp/comments/1ir8q1n/how_does_the_cash_app_scam_work/

- https://www.reddit.com/r/hypotheticalsituation/comments/19dwu73/hypothetically_is_there_any_point_in_money/

- https://www.reddit.com/r/mkindia/comments/1e4j2w7/is_the_kyc_requirement_msg_from_global_morning_a/

- https://www.reddit.com/r/Buttcoin/comments/1fyhrve/the_ticking_crypto_time_bomb_that_nobody_wants_to/

- https://www.reddit.com/r/TalesFromYourBank/comments/1duhdis/why_are_customers_so_hostile_against_kyc_questions/

- https://www.reddit.com/r/CashApp/comments/1f5x68p/this_post_is_a_warning_to_everyone_out_there/

- https://www.reddit.com/r/CashApp/comments/1g1cxou/cash_app_fraud/

- https://www.reddit.com/r/Bitcoin/comments/1excpjv/should_i_buy_btc_on_cashapp/

- https://www.reddit.com/r/explainlikeimfive/comments/1de09aw/eli5_whats_the_concept_of_money_laundering/

- https://cryptobriefing.com/p2p-crypto-security-proposal/

- https://www.reddit.com/r/BitcoinBeginners/comments/1i5ivjp/is_cashapp_a_reliable_app_for_bitcoin/

- https://www.reddit.com/r/TikTokCringe/comments/1dec2tw/money_laundering_101/

- https://www.reddit.com/r/CoinBase/comments/1ba4k9d/kyc/

- https://www.reddit.com/r/BitcoinBeginners/comments/1ii3y9x/cash_app/

- https://www.reddit.com/r/Accounting/comments/36kvq1/how_to_launder_300000/

- https://www.reddit.com/r/plutus/comments/1efa96p/is_this_legit_kyc_reverification_request_by_mail/

- https://www.reddit.com/r/BitcoinBeginners/comments/1g1qpry/is_cashapp_safe_to_buy_bitcoin_on/

- https://www.reddit.com/r/explainlikeimfive/comments/1efjwrp/eli5_how_is_money_laundering_detected_and/

- https://www.reddit.com/r/FTXOfficial/comments/1hyhdtp/is_ftx_once_again_scamming_their_clients_ftx_is/

- https://www.reddit.com/r/Scams/comments/11npghb/family_member_known_to_be_irresponsible_with/

- https://www.reddit.com/r/explainlikeimfive/comments/1blggg3/eli5_how_do_criminals_money_launder_using_crypto/

- https://www.reddit.com/r/AMLCompliance/

- https://www.reddit.com/r/AskEconomics/comments/1iwuju0/is_crypto_today_just_pure_money_laundering/

- https://www.reddit.com/r/moneylaundering/comments/1eqa66v/struggling_to_get_kyc_or_aml_entry_level_position/

- https://www.reddit.com/r/CashApp/comments/14b9tax/cashapp_closed_my_account_with_183k_on_it_and_is/

- https://www.reddit.com/r/CoinBase/comments/1fd0cpf/does_coinbase_think_im_money_laundering/

- https://www.reddit.com/r/AMLCompliance/comments/1dtz40h/questions_on_kyc_process/

- https://www.reddit.com/r/hacking/comments/15rb0mg/how_do_hackers_clean_their_money/

- https://www.reddit.com/r/moneylaundering/comments/18vwfiw/i_want_to_get_into_amlkyc_considering_ica/

- https://www.reddit.com/r/Scams/comments/1dtvx5h/cash_app_scam_is_this_a_new_tactic/

- https://www.reddit.com/r/CashApp/comments/1cln79v/you_ever_been_so_broke_you_wish_one_of_those_cash/

- https://www.reddit.com/r/CashApp/comments/1fl2ltr/is_this_a_scam/

- https://www.reddit.com/r/Scams/comments/1h20iug/how_to_avoid_cash_app_scams/

- https://www.reddit.com/r/CashApp/comments/197bncb/cash_app_fraud/